Vat Login Hmrc

Vat Login Hmrc - You’ll need sign in details and your vat number to access this service. Use your vat online account to add vat tax services. While trying to authenticate with hmrc or submit a vat return, the following message may appear: Learn how to sign in or set up an account for hmrc online services, including vat, self assessment, corporation tax and more. The good news is that since last november agents who are not themselves registered for vat can now register with hmrc’s vat online service and start preparing to. Sign in to your business tax account to check your tax position, make returns and payments, and access over 40 taxes including vat. These schemes don’t change the vat you charge on products and services but make working out what you owe simpler and. You need a government gateway user id. Once this is done you can file vat returns and manage your vat account on government gateway. Hmrc free vat return services. Learn how to sign in or set up an account for hmrc online services, including vat, self assessment, corporation tax and more. Use this service to manage your vat returns, payments, penalties and more. Pay your vat bill online. You’ll need sign in details and your vat number to access this service. “hmrc can go back four years with regards vat, so effectively. You can pay hm revenue and customs (hmrc) online by:approving a payment through your bank account using your online banking details; The good news is that since last november agents who are not themselves registered for vat can now register with hmrc’s vat online service and start preparing to. While trying to authenticate with hmrc or submit a vat return, the following message may appear: Jas dhillon, vat partner at business advisers and chartered accountants lubbock fine, told constrution news: If your liability changes and fluctuates by more than 20%, you may be able to request an adjustment. While trying to authenticate with hmrc or submit a vat return, the following message may appear: We were unable to authenticate with hmrc. You need a government gateway user id. Hmrc free vat return services. They’re created automatically from your receipts, sales and invoices and are ready to file with hmrc at the tap of a button. Sign in to your business tax account to check your tax position, make returns and payments, and access over 40 taxes including vat. Learn how to sign in or set up an account for hmrc online services, including vat, self assessment, corporation tax and more. Once this is done you can file vat returns and manage your vat account on. This is the standard process for each accounting period. You’ll need sign in details and your vat number to access this service. Pay your vat bill online. Use your vat online account to add vat tax services. Personal tax account setup made simple with our 2025 hmrc guide. Sign in to your business tax account to check your tax position, make returns and payments, and access over 40 taxes including vat. Personal tax account setup made simple with our 2025 hmrc guide. This is the standard process for each accounting period. If your liability changes and fluctuates by more than 20%, you may be able to request an. You can pay hm revenue and customs (hmrc) online by:approving a payment through your bank account using your online banking details; Jas dhillon, vat partner at business advisers and chartered accountants lubbock fine, told constrution news: If your liability changes and fluctuates by more than 20%, you may be able to request an adjustment. “hmrc can go back four years. Hmrc offers several optional vat schemes. Anna’s automated vat service makes for easy vat returns. You’ll need sign in details and your vat number to access this service. Use your vat online account to add vat tax services. Jas dhillon, vat partner at business advisers and chartered accountants lubbock fine, told constrution news: Hmrc free vat return services. Find out how to get help with signing in and access. Learn how to sign in or set up an account for hmrc online services, including vat, self assessment, corporation tax and more. Use your vat online account to add vat tax services. Jas dhillon, vat partner at business advisers and chartered accountants lubbock fine,. They’re created automatically from your receipts, sales and invoices and are ready to file with hmrc at the tap of a button. Find out how to get help with signing in and access. These schemes don’t change the vat you charge on products and services but make working out what you owe simpler and. The payment amount is calculated by. Anna’s automated vat service makes for easy vat returns. Use this service to manage your vat returns, payments, penalties and more. We were unable to authenticate with hmrc. You need a government gateway user id. Personal tax account setup made simple with our 2025 hmrc guide. If your liability changes and fluctuates by more than 20%, you may be able to request an adjustment. We were unable to authenticate with hmrc. They’re created automatically from your receipts, sales and invoices and are ready to file with hmrc at the tap of a button. Use your vat online account to add vat tax services. Hmrc free vat. The good news is that since last november agents who are not themselves registered for vat can now register with hmrc’s vat online service and start preparing to. Learn how to sign in or set up an account for hmrc online services, including vat, self assessment, corporation tax and more. Use your vat online account to add vat tax services. “hmrc can go back four years with regards vat, so effectively. Pay your vat bill online. Login to your vat online ledger via your government gateway account and fill in the return. We were unable to authenticate with hmrc. They’re created automatically from your receipts, sales and invoices and are ready to file with hmrc at the tap of a button. Three taxpayer education colleges were unsuccessful in their vat appeal in st patrick’s international college limited, london college of contemporary arts limited &. While trying to authenticate with hmrc or submit a vat return, the following message may appear: Personal tax account setup made simple with our 2025 hmrc guide. You’ll need sign in details and your vat number to access this service. Jas dhillon, vat partner at business advisers and chartered accountants lubbock fine, told constrution news: These schemes don’t change the vat you charge on products and services but make working out what you owe simpler and. Once this is done you can file vat returns and manage your vat account on government gateway. Use this service to manage your vat returns, payments, penalties and more.Hmrc Vat Management And Leadership

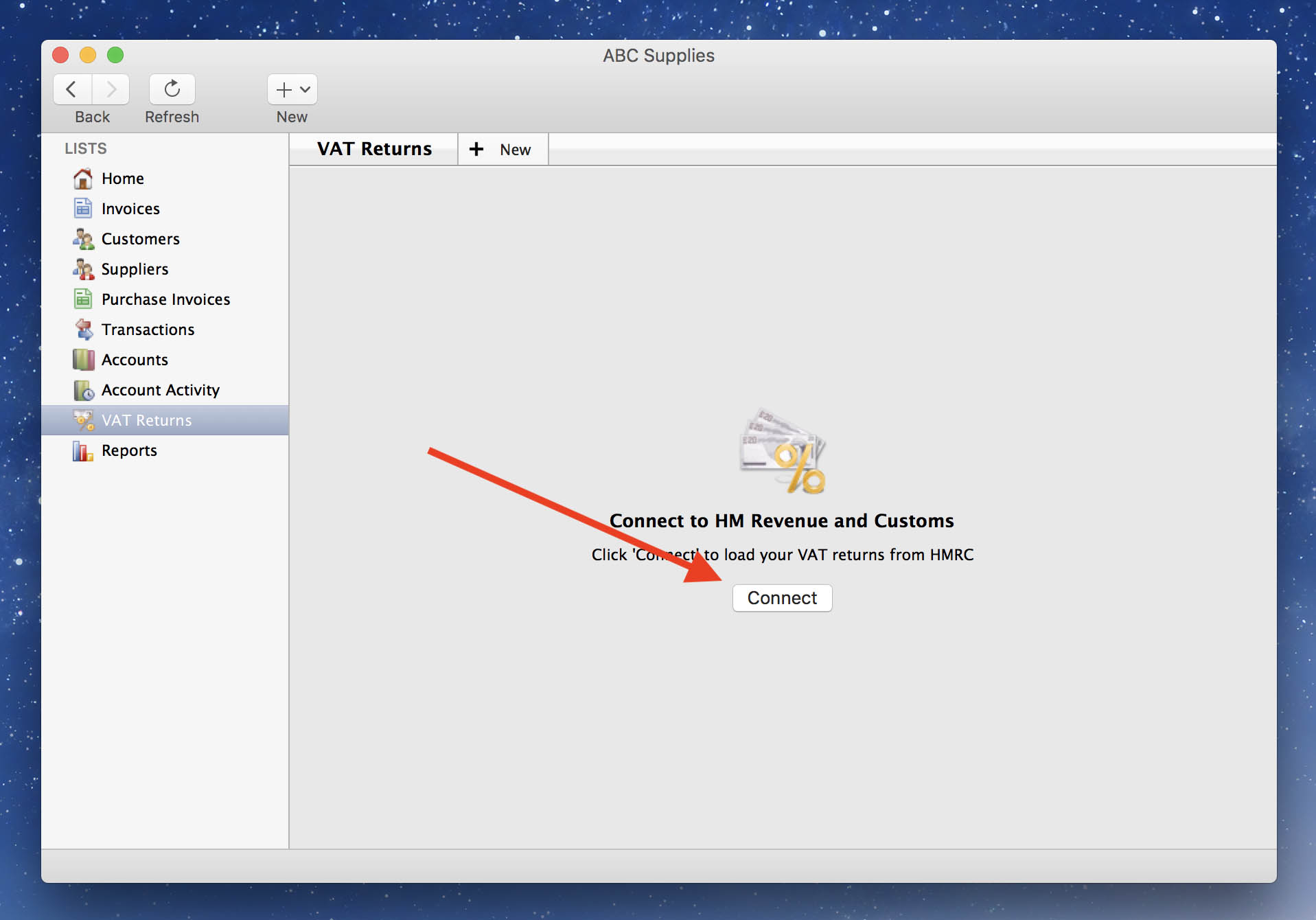

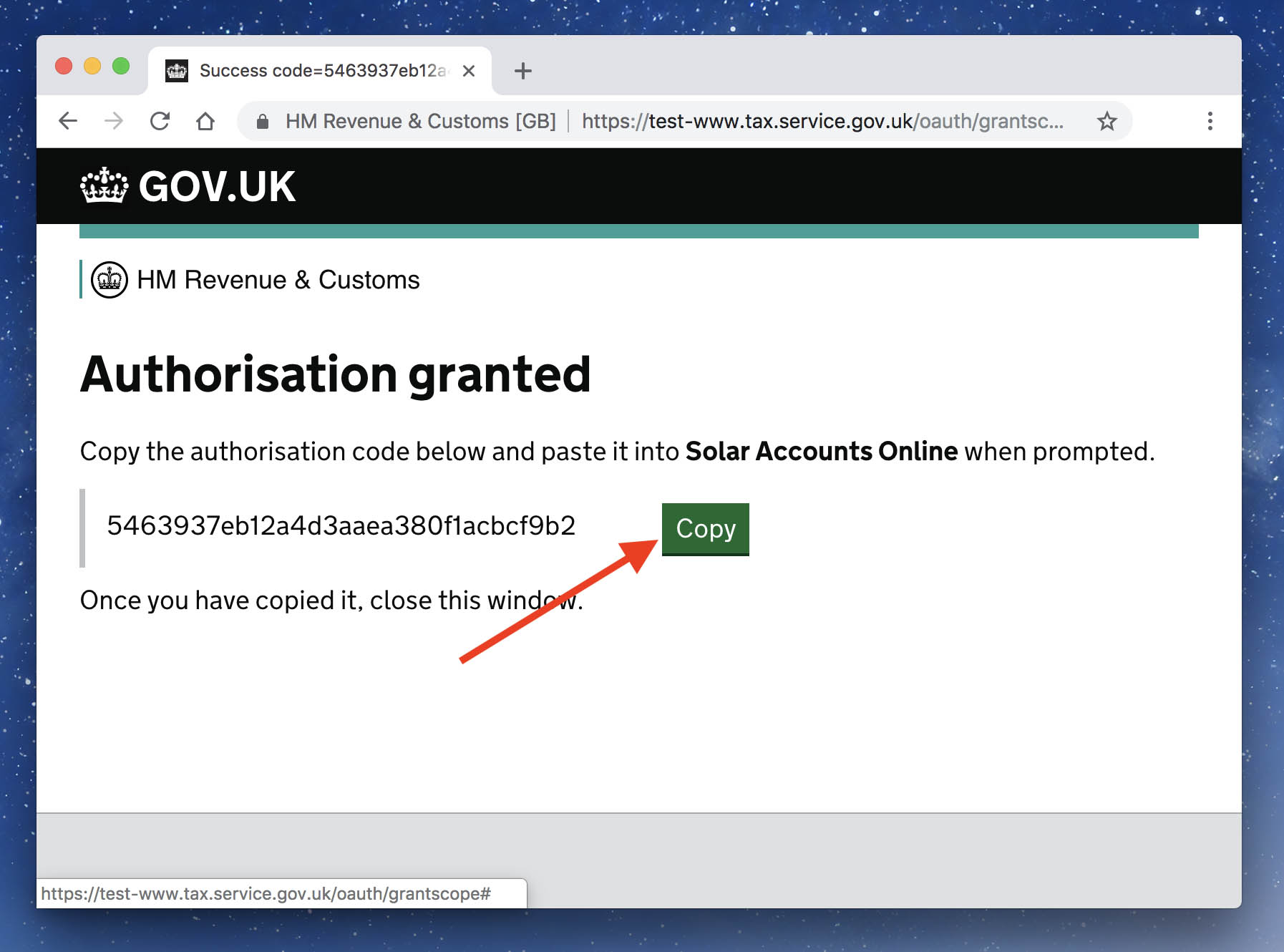

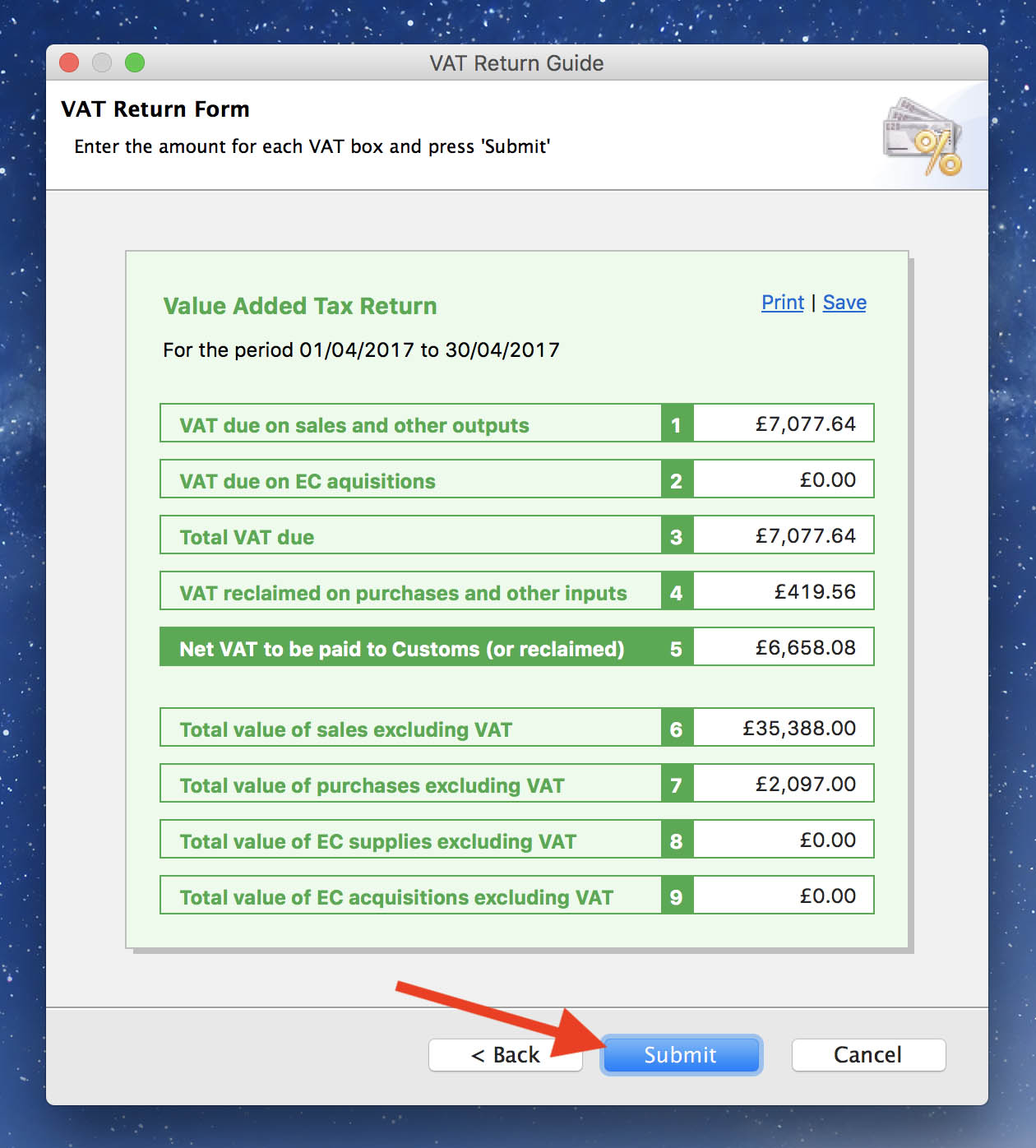

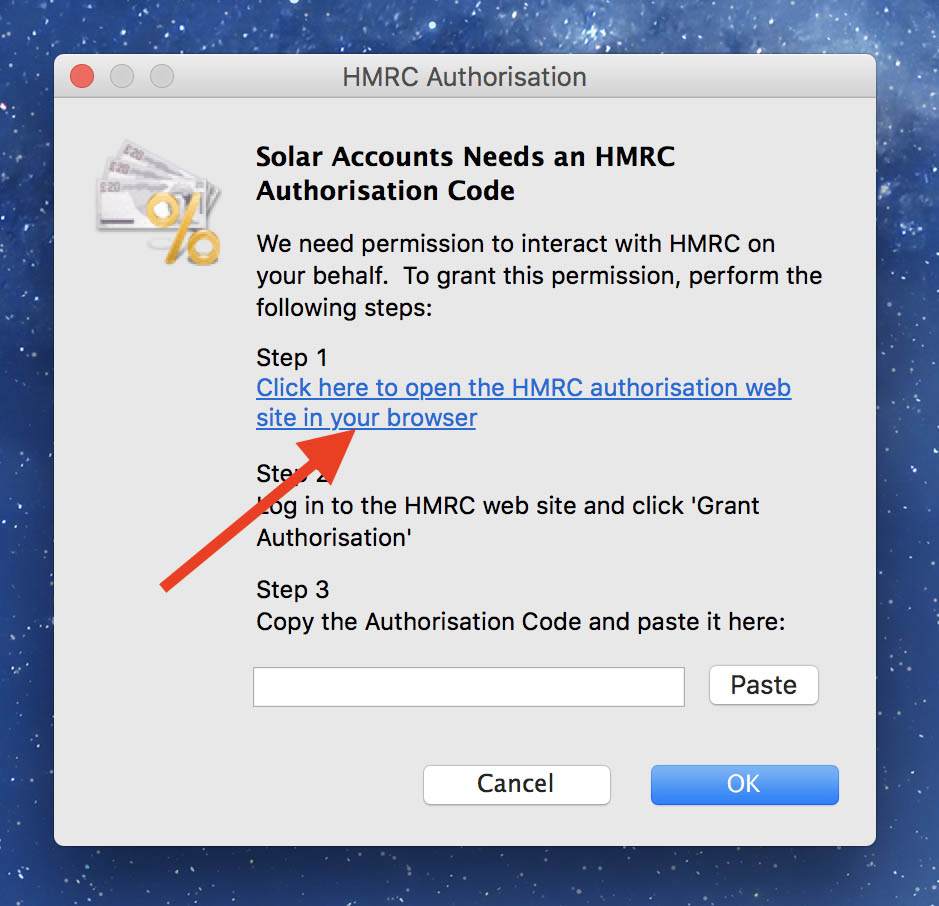

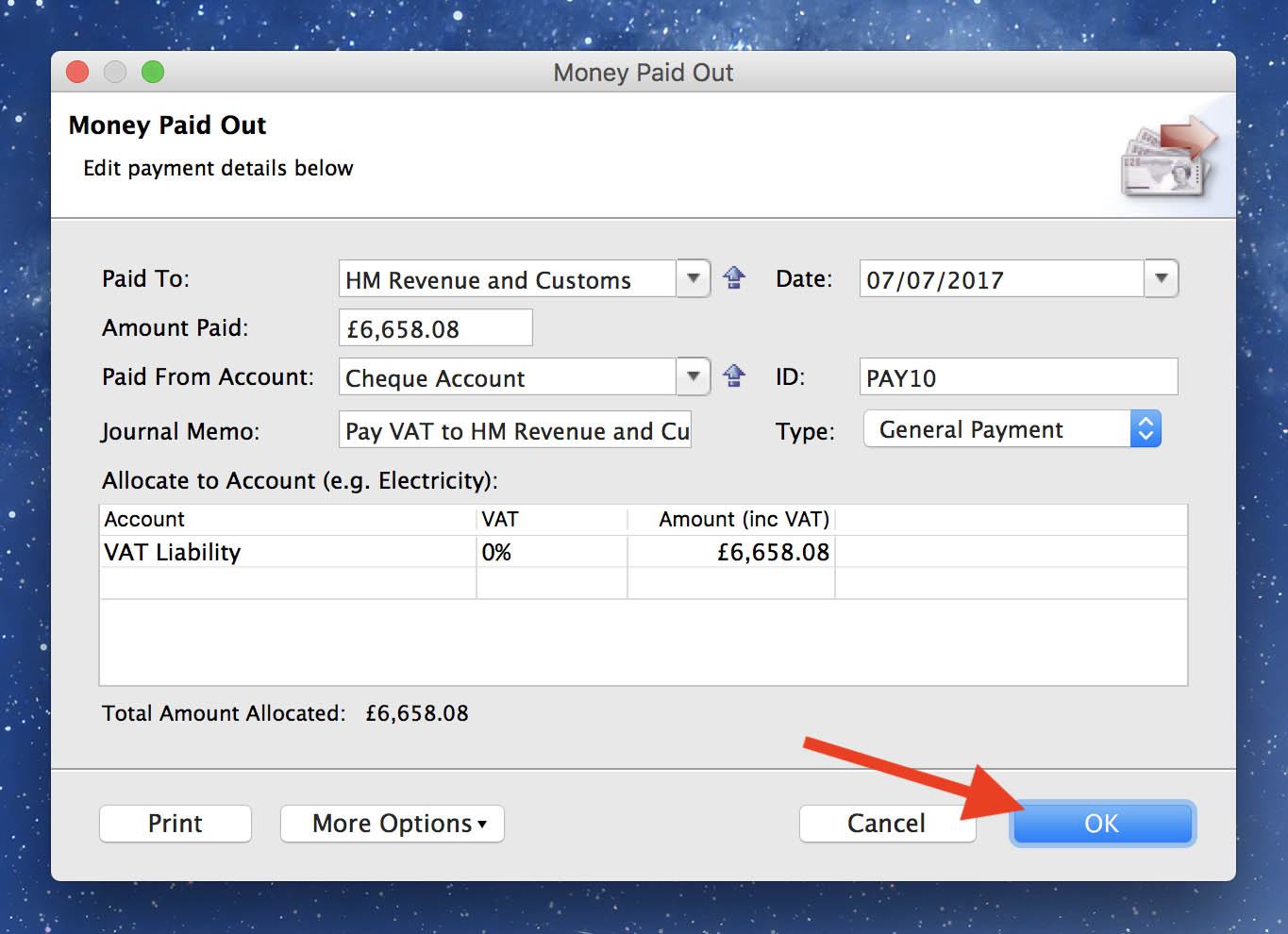

How to View and Submit HMRC VAT Returns

Hmrc Login

How to View and Submit HMRC VAT Returns

How to View and Submit HMRC VAT Returns

How to View and Submit HMRC VAT Returns

How to View and Submit HMRC VAT Returns

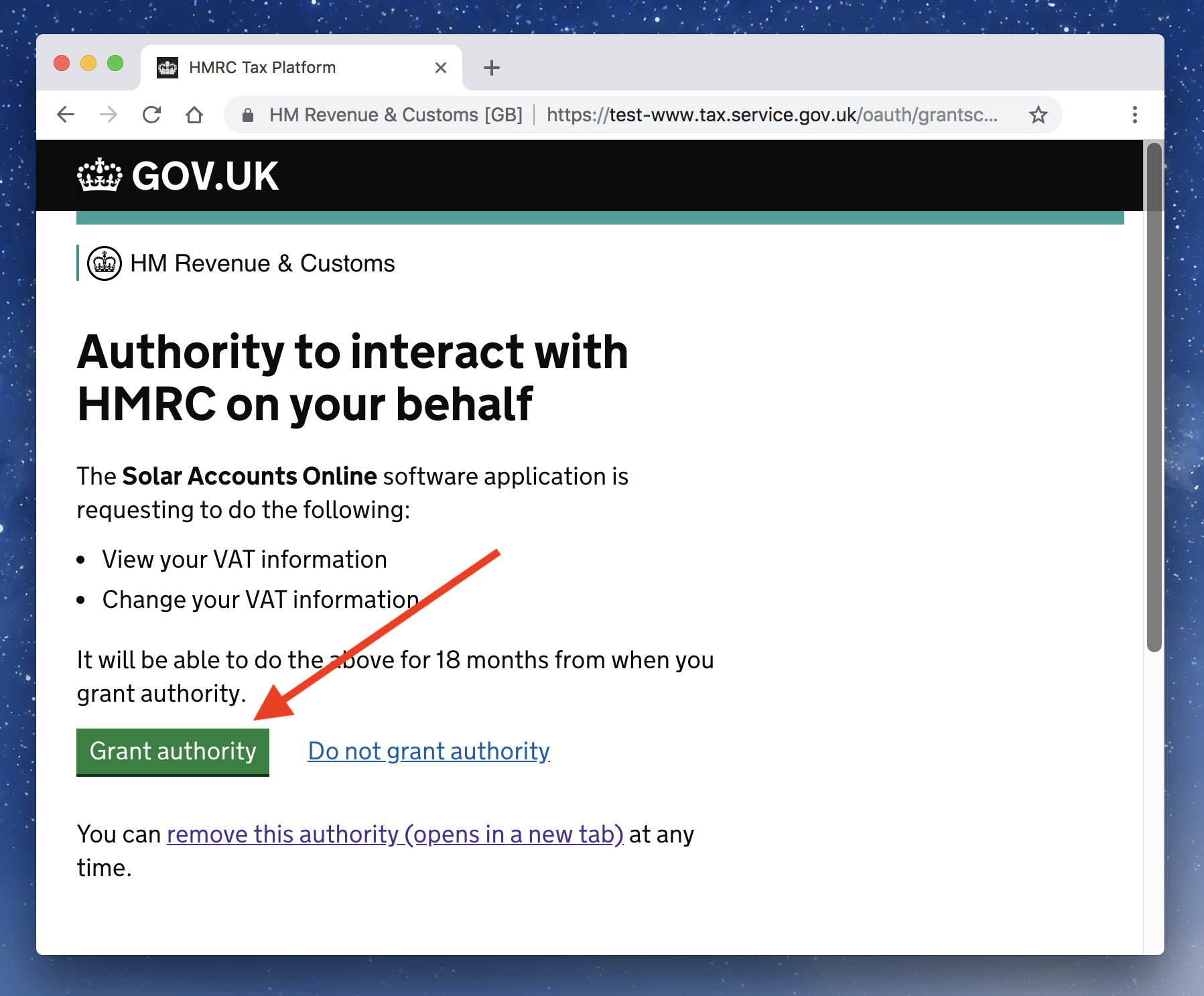

How to connect to HMRC for Making Tax Digital Debitoor

How to View and Submit HMRC VAT Returns

How to connect to HMRC for Making Tax Digital Debitoor

Sign In To Your Business Tax Account To Check Your Tax Position, Make Returns And Payments, And Access Over 40 Taxes Including Vat.

This Is The Standard Process For Each Accounting Period.

Find Out How To Get Help With Signing In And Access.

Hmrc Offers Several Optional Vat Schemes.

Related Post: