My529 Utah Login

My529 Utah Login - A financial advisor isn’t necessary. Open a path of possibility with a my529 account. The state in which you or your beneficiary pay taxes or live may offer a 529 plan that provides state tax or other benefits, such as financial aid, scholarship funds, and protection from creditors, not otherwise available to you by investing in my529. The utah legislature established my529 in 1996 to help you save for college. Contribute all or a portion of your utah state income tax refund to your my529 account(s). Investments in my529 are not insured or guaranteed by my529, the utah board of higher education, the utah education savings board of trustees, any other state or. What is a 529 plan? Open an account for free. Initiate a rollover from another 529 plan or from a coverdell education savings account into the new account by submitting an incoming direct rollover form. Utah state income tax refund. For a copy of the program description, call 800.418.2551 or visit my529.org. What is a 529 plan? Utah state income tax refund. Are you a utah taxpayer? Choosing my529 you’re in control. Investments in my529 are not insured or guaranteed by my529, the utah board of higher education, the utah education savings board of trustees, any other state or. The utah legislature established my529 in 1996 to help you save for college. You can help them further pave the path to their future educational goals with an offer from my529, utah’s educational savings plan. Open an account for free. Open a path of possibility with a my529 account. Investing now for future educational costs can add up and save you from paying back money you borrowed with interest. My529, utah’s educational savings plan, can help you prepare now for your child’s educational future. The state in which you or your beneficiary pays taxes or lives may offer a 529 plan that provides state tax or other benefits, such. My529 has been helping families save for education for more than 20 years. Investments in my529 are not insured or guaranteed by my529, the utah board of higher education, the utah education savings board of trustees, any other state or. No enrollment fee and no minimum contribution or balance is required. A financial advisor isn’t necessary. The state in which. Choosing my529 you’re in control. Utah state income tax refund. The state in which you or your beneficiary pay taxes or live may offer a 529 plan that provides state tax or other benefits, such as financial aid, scholarship funds, and protection from creditors, not otherwise available to you by investing in my529. It’s never too early to start, and. 529 plans are sponsored by states and educational institutions, and are authorized by section 529 of the internal revenue code. My529 has been helping families save for education for more than 20 years. Secure login portal for my529 account management. Utah state income tax refund. Open an account for free. Choosing my529 you’re in control. The mission of my529 is to provide the best 529 educational savings plan at the lowest possible cost, and to make my529 the plan of choice for utah residents. What is a 529 plan? No enrollment fee and no minimum contribution or balance is required. Account owners control their accounts — not the beneficiary. The mission of my529 is to provide the best 529 educational savings plan at the lowest possible cost, and to make my529 the plan of choice for utah residents. Are you a utah taxpayer? The state in which you or your beneficiary pay taxes or live may offer a 529 plan that provides state tax or other benefits, such as. My529, utah’s educational savings plan, can help you prepare now for your child’s educational future. The state in which you or your beneficiary pay taxes or live may offer a 529 plan that provides state tax or other benefits, such as financial aid, scholarship funds, and protection from creditors, not otherwise available to you by investing in my529. You can. My529 has been helping families save for education for more than 20 years. It’s never too early to start, and you can save what you want, when you want. Account owners control their accounts — not the beneficiary. Utah state income tax refund. You can help them further pave the path to their future educational goals with an offer from. My529 also has tax advantages that helps you reach your savings goals. My529, utah’s educational savings plan, can help you prepare now for your child’s educational future. Account owners control their accounts — not the beneficiary. Utah state income tax refund. The utah legislature established my529 in 1996 to help you save for college. Investing now for future educational costs can add up and save you from paying back money you borrowed with interest. What is a 529 plan? Account owners control their accounts — not the beneficiary. 529 plans are sponsored by states and educational institutions, and are authorized by section 529 of the internal revenue code. Secure login portal for my529 account. 529 plans are sponsored by states and educational institutions, and are authorized by section 529 of the internal revenue code. The state in which you or your beneficiary pays taxes or lives may offer a 529 plan that provides state tax or other benefits, such as financial aid, scholarship funds, and protection from creditors, not otherwise available to you by investing in my529. You can help them further pave the path to their future educational goals with an offer from my529, utah’s educational savings plan. Utah state income tax refund. Investments in my529 are not insured or guaranteed by my529, the utah board of higher education, the utah education savings board of trustees, any other state or. My529 also has tax advantages that helps you reach your savings goals. Secure login portal for my529 account management. Investing now for future educational costs can add up and save you from paying back money you borrowed with interest. It’s never too early to start, and you can save what you want, when you want. Account owners control their accounts — not the beneficiary. A financial advisor isn’t necessary. What is a 529 plan? My529, utah’s educational savings plan, can help you prepare now for your child’s educational future. Open a path of possibility with a my529 account. For a copy of the program description, call 800.418.2551 or visit my529.org. Open an account for free.Click here to bookmark your login page my529

Spring 2024 my529

Book Your Summer 2022 & my529 Utah State Library Division

How do I connect my checking account to my529 for withdrawals & contributions? — Wrought Advisors

My529 is Utah’s educational savings plan; learn how you can get 100 return YouTube

Click here to bookmark your login page my529

my529 Prepaid Access Card FAQ my529

New look for my529’s website my529

Utah 529 Plan Rules And College Savings Options

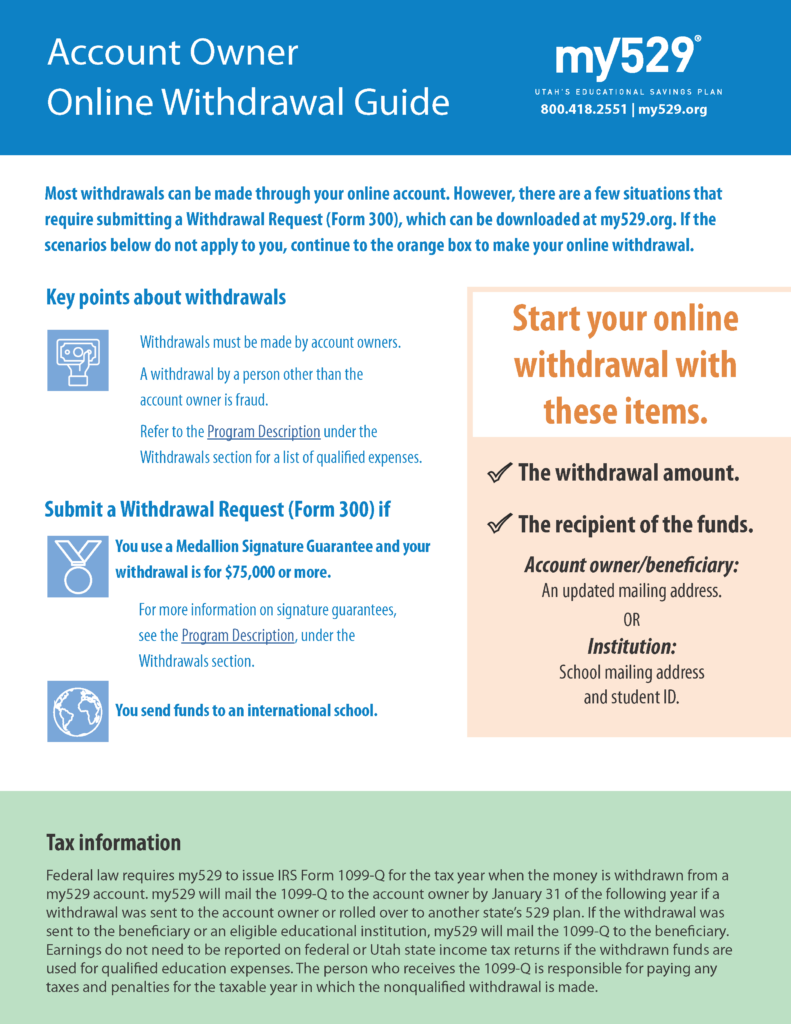

Withdrawals my529

No Enrollment Fee And No Minimum Contribution Or Balance Is Required.

Are You A Utah Taxpayer?

The State In Which You Or Your Beneficiary Pay Taxes Or Live May Offer A 529 Plan That Provides State Tax Or Other Benefits, Such As Financial Aid, Scholarship Funds, And Protection From Creditors, Not Otherwise Available To You By Investing In My529.

The Utah Legislature Established My529 In 1996 To Help You Save For College.

Related Post: