Calsavers Employer Login California

Calsavers Employer Login California - Most california businesses will be required to participate in the calsavers retirement savings program if they do not sponsor their own workplace retirement plan. Enrollment is automatic, investing is easy, and the program is simple for employers. Log in and change your investment choice, choose a different contribution rate, or set a beneficiary. Set up your account now: An employer must register and participate in calsavers if they do not sponsor a retirement plan and have one or more californian employees. Log in to add or update your bank information if you fund contributions through ach debit or have a specific account debited. Set up your account already registered? Set up your account later: Calsavers is california’s retirement savings program designed for. Calsavers is a retirement savings program for private sector workers whose employers do not offer a retirement plan. An employer must register and participate in calsavers if they do not sponsor a retirement plan and have one or more californian employees. Calsavers is california’s retirement savings program designed for. Enrollment is automatic, investing is easy, and the program is simple for employers. Calsavers, california’s new retirement savings program for employees who lack access to a plan at work. Calsavers sends a notification to employees. Employers upload a roster of eligible employees into the employer portal. How do savers join calsavers? Calsavers helps california workers save for retirement with support from their employers. By law, eligible california employers must register and facilitate the program by specific deadlines. Logging into your account the launch of the redesigned employer portal is expected to start on may 25 and continue through the beginning of july. Set up your account later: When you log in to your account, you’ll. Deadlines have passed for employers with 5 or more employees. Most california businesses will be required to participate in the calsavers retirement savings program if they do not sponsor their own workplace retirement plan. Employers upload a roster of eligible employees into the employer portal. Calsavers, california’s new retirement savings program for employees who lack access to a plan at work. Deadlines have passed for employers with 5 or more employees. How do savers join calsavers? Calsavers is california’s retirement savings program designed for. Log in and change your investment choice, choose a different contribution rate, or set a beneficiary. How do savers join calsavers? Set up your account now: Log in and change your investment choice, choose a different contribution rate, or set a beneficiary. Review frequently asked questions and answers about the calsavers program. Calsavers is designed to be as easy as possible for employers, with no employer fees, no employer contributions, and minimal ongoing responsibilities. How do savers join calsavers? Set up your account already registered? Log in and change your investment choice, choose a different contribution rate, or set a beneficiary. We offer a number of resources to help you complete this step. When you log in to your account, you’ll. Set up your account later: When you log in to your account, you’ll. Calsavers is a retirement savings program for private sector workers whose employers do not offer a retirement plan. This program gives employers an easy way to help. By law, eligible california employers must register and facilitate the program by specific deadlines. Deadlines have passed for employers with 5 or more employees. How do savers join calsavers? Set up your account now: Employers upload a roster of eligible employees into the employer portal. Set up your account later: This program gives employers an easy way to help. Employers should register for an. Deadlines have passed for employers with 5 or more employees. Review frequently asked questions and answers about the calsavers program. How do savers join calsavers? Log in and change your investment choice, choose a different contribution rate, or set a beneficiary. Calsavers is a retirement savings program for private sector workers whose employers do not offer a retirement plan. Calsavers helps california workers save for retirement with support from their employers. Calsavers is designed to be as easy as possible for employers, with no employer. Calsavers helps california workers save for retirement with support from their employers. Calsavers is california’s retirement savings program for workers who do not have a way to save for retirement at work. Set up your account later: Calsavers, california’s new retirement savings program for employees who lack access to a plan at work. Calsavers is designed to be as easy. Log in to add or update your bank information if you fund contributions through ach debit or have a specific account debited. Employers should register for an. Calsavers is california’s retirement savings program for workers who do not have a way to save for retirement at work. Logging into your account the launch of the redesigned employer portal is expected. Calsavers is california’s retirement savings program for workers who do not have a way to save for retirement at work. Calsavers sends a notification to employees. Enrollment is automatic, investing is easy, and the program is simple for employers. Calsavers is california’s retirement savings program designed for. Employers upload a roster of eligible employees into the employer portal. How do savers join calsavers? Calsavers, california’s new retirement savings program for employees who lack access to a plan at work. Log in to add or update your bank information if you fund contributions through ach debit or have a specific account debited. If you have additional questions, contact client services. An employer must register and participate in calsavers if they do not sponsor a retirement plan and have one or more californian employees. Deadlines have passed for employers with 5 or more employees. Log in and change your investment choice, choose a different contribution rate, or set a beneficiary. Review frequently asked questions and answers about the calsavers program. Set up your account later: Employers should register for an. Calsavers helps california workers save for retirement with support from their employers.CalSavers will apply to more employers

CalSavers California's Retirement Savings Program YouTube

All About CalSavers Exemptions Hourly, Inc.

What is CalSavers? What you need to know. Register, Login, Find out who the mandates apply to

CalSavers What employers need to know True Root Financial

CalSavers on LinkedIn CalSavers Employer Information

Employers can now register to help employees save through CalSavers CDA

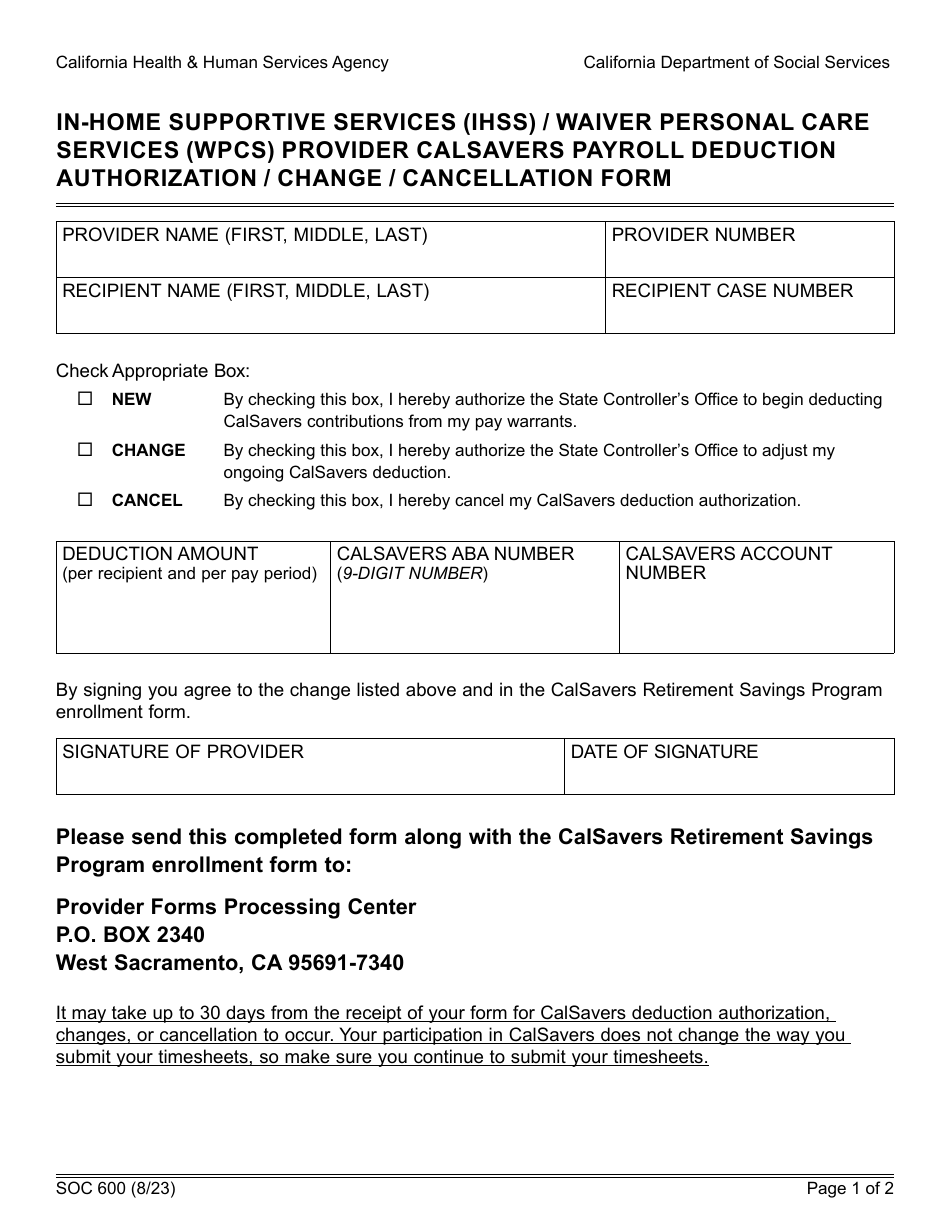

Form SOC600 Fill Out, Sign Online and Download Fillable PDF, California Templateroller

CalSavers 란? KAMA

Poway Chamber Education Webinar Series CalSavers The New Mandatory CA Employer Retirement Law

When You Log In To Your Account, You’ll.

This Program Gives Employers An Easy Way To Help.

Calsavers Is A Retirement Savings Program For Private Sector Workers Whose Employers Do Not Offer A Retirement Plan.

Logging Into Your Account The Launch Of The Redesigned Employer Portal Is Expected To Start On May 25 And Continue Through The Beginning Of July.

Related Post: