Arkansas 529 Login

Arkansas 529 Login - Enroll now have an account, but have never logged on? Up to a $5,000 arkansas tax deduction ($10,000 for married couples); And an automatic investment plan for as little as $10/month. Your brighter future account provides a highly rated mobile app that makes it easy for you to track progress towards your goals, make contributions, and invite friends and family to be part of your savings journey. Arkansas brighter future 529 plan. Your arkansas brighter future 529 plan offers the flexibility to use funds at any eligible, accredited public or private college, university, or trade school worldwide; If you have multiple accounts, enter any one account number, along with your own ssn and permanent address zip code. Manage your account anywhere, anytime, from any device. Please enter valid 529 account number. Protecting consumers, educating investors, and safeguarding arkansas’s financial markets. Enroll now have an account, but have never logged on? Protecting consumers, educating investors, and safeguarding arkansas’s financial markets. Up to a $5,000 arkansas tax deduction ($10,000 for married couples); Please enter valid 529 account number. Your arkansas brighter future 529 plan offers the flexibility to use funds at any eligible, accredited public or private college, university, or trade school worldwide; The arkansas brighter future 529 plan is designed to help families reach their educational goals. Manage your account anywhere, anytime, from any device. Your brighter future account provides a highly rated mobile app that makes it easy for you to track progress towards your goals, make contributions, and invite friends and family to be part of your savings journey. Arkansas brighter future 529 plan. Arkansas taxpayers are eligible to deduct up to $5,000 (up to $10,000 for married couples making a proper election) from their adjusted gross income calculation for contributions to an arkansas brighter future 529 plan account. Arkansas taxpayers are eligible to deduct up to $5,000 (up to $10,000 for married couples making a proper election) from their adjusted gross income calculation for contributions to an arkansas brighter future 529 plan account. Manage your account anywhere, anytime, from any device. And an automatic investment plan for as little as $10/month. Up to a $5,000 arkansas tax deduction. Enroll now have an account, but have never logged on? Your arkansas brighter future 529 plan offers the flexibility to use funds at any eligible, accredited public or private college, university, or trade school worldwide; Arkansas brighter future 529 plan. Create a username and password more questions about logging. Arkansas taxpayers are eligible to deduct up to $5,000 (up to. And an automatic investment plan for as little as $10/month. Enroll now have an account, but have never logged on? Your brighter future account provides a highly rated mobile app that makes it easy for you to track progress towards your goals, make contributions, and invite friends and family to be part of your savings journey. Manage your account anywhere,. Up to a $5,000 arkansas tax deduction ($10,000 for married couples); Your arkansas brighter future 529 plan offers the flexibility to use funds at any eligible, accredited public or private college, university, or trade school worldwide; If you have multiple accounts, enter any one account number, along with your own ssn and permanent address zip code. And an automatic investment. Arkansas taxpayers are eligible to deduct up to $5,000 (up to $10,000 for married couples making a proper election) from their adjusted gross income calculation for contributions to an arkansas brighter future 529 plan account. Protecting consumers, educating investors, and safeguarding arkansas’s financial markets. Manage your account anywhere, anytime, from any device. Your arkansas brighter future 529 plan offers the. Please enter valid 529 account number. If you have multiple accounts, enter any one account number, along with your own ssn and permanent address zip code. Up to a $5,000 arkansas tax deduction ($10,000 for married couples); And an automatic investment plan for as little as $10/month. Want to begin investing with arkansas brighter future direct plan? And an automatic investment plan for as little as $10/month. Arkansas brighter future 529 plan. Up to a $5,000 arkansas tax deduction ($10,000 for married couples); Arkansas taxpayers are eligible to deduct up to $5,000 (up to $10,000 for married couples making a proper election) from their adjusted gross income calculation for contributions to an arkansas brighter future 529 plan. And an automatic investment plan for as little as $10/month. Manage your account anywhere, anytime, from any device. Up to a $5,000 arkansas tax deduction ($10,000 for married couples); Arkansas brighter future 529 plan. Arkansas taxpayers are eligible to deduct up to $5,000 (up to $10,000 for married couples making a proper election) from their adjusted gross income calculation for. Enroll now have an account, but have never logged on? Please enter valid 529 account number. Want to begin investing with arkansas brighter future direct plan? Protecting consumers, educating investors, and safeguarding arkansas’s financial markets. Manage your account anywhere, anytime, from any device. If you have multiple accounts, enter any one account number, along with your own ssn and permanent address zip code. Up to a $5,000 arkansas tax deduction ($10,000 for married couples); Arkansas brighter future 529 plan. Please enter valid 529 account number. Your brighter future account provides a highly rated mobile app that makes it easy for you to track. And an automatic investment plan for as little as $10/month. Want to begin investing with arkansas brighter future direct plan? Please enter valid 529 account number. Arkansas taxpayers are eligible to deduct up to $5,000 (up to $10,000 for married couples making a proper election) from their adjusted gross income calculation for contributions to an arkansas brighter future 529 plan account. If you have multiple accounts, enter any one account number, along with your own ssn and permanent address zip code. Enroll now have an account, but have never logged on? Up to a $5,000 arkansas tax deduction ($10,000 for married couples); Manage your account anywhere, anytime, from any device. Your arkansas brighter future 529 plan offers the flexibility to use funds at any eligible, accredited public or private college, university, or trade school worldwide; Protecting consumers, educating investors, and safeguarding arkansas’s financial markets. Your brighter future account provides a highly rated mobile app that makes it easy for you to track progress towards your goals, make contributions, and invite friends and family to be part of your savings journey.Gift 529 is a way to ensure an educational future for children

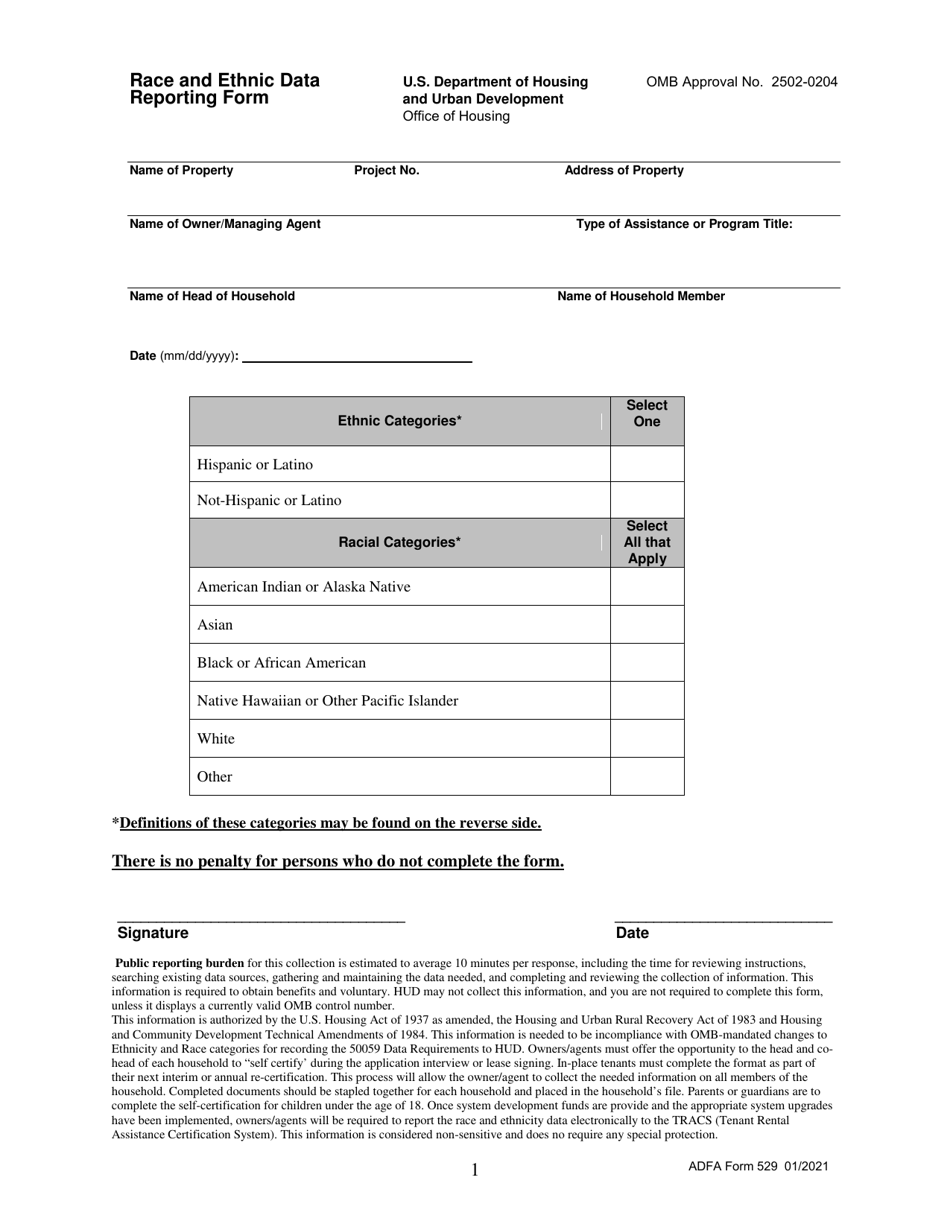

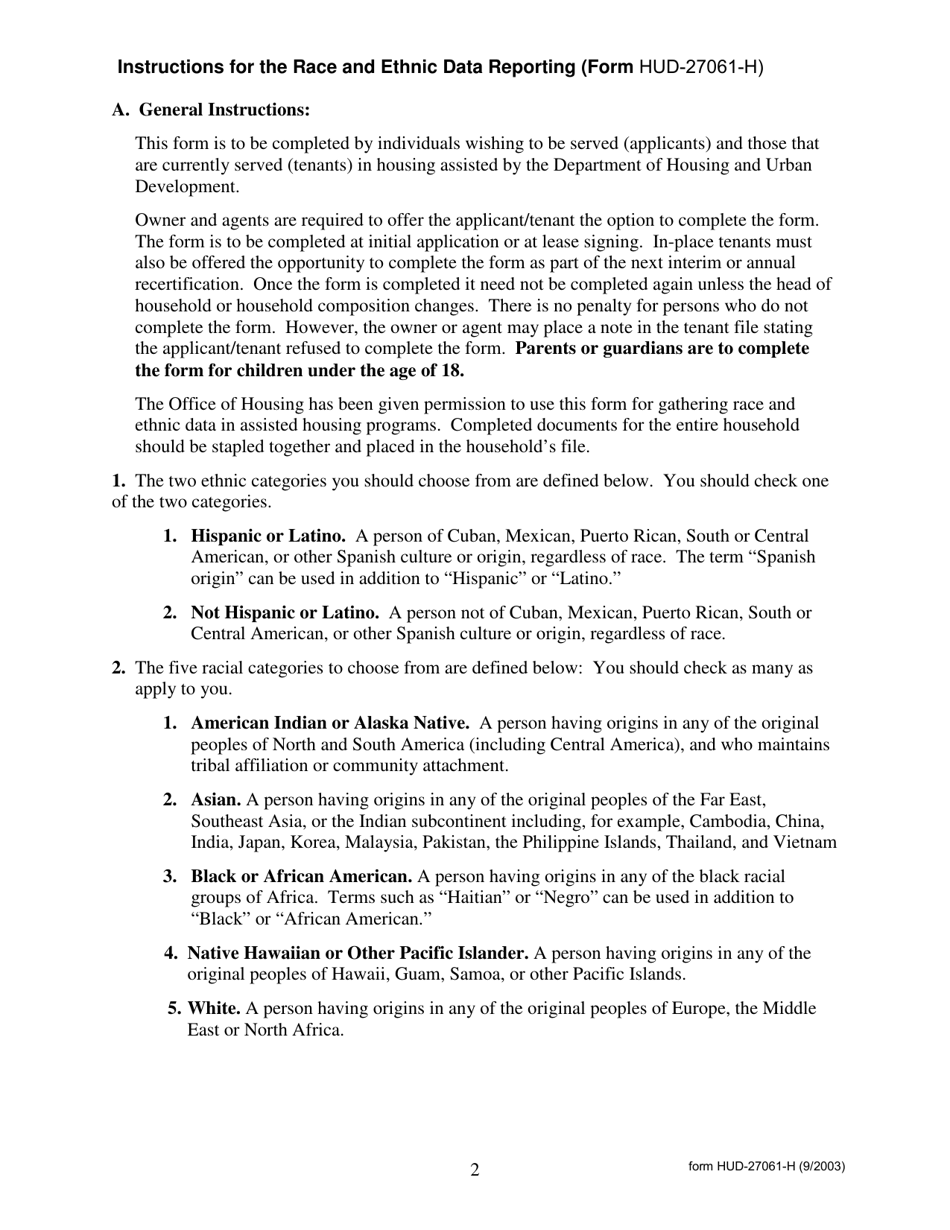

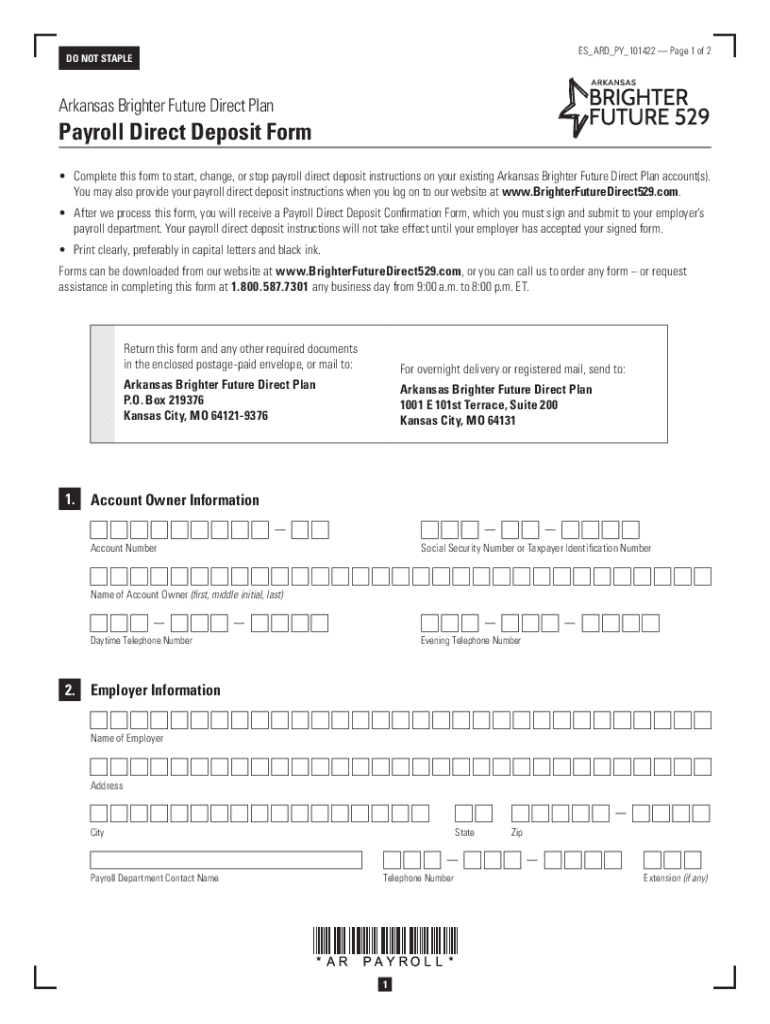

ADFA Form 529 Fill Out, Sign Online and Download Fillable PDF, Arkansas Templateroller

Arkansas Brighter Future 529 Program Arkansas House of Representatives

Arkansas 529 on Instagram “Here are three things you may not know about an Arkansas 529 savings

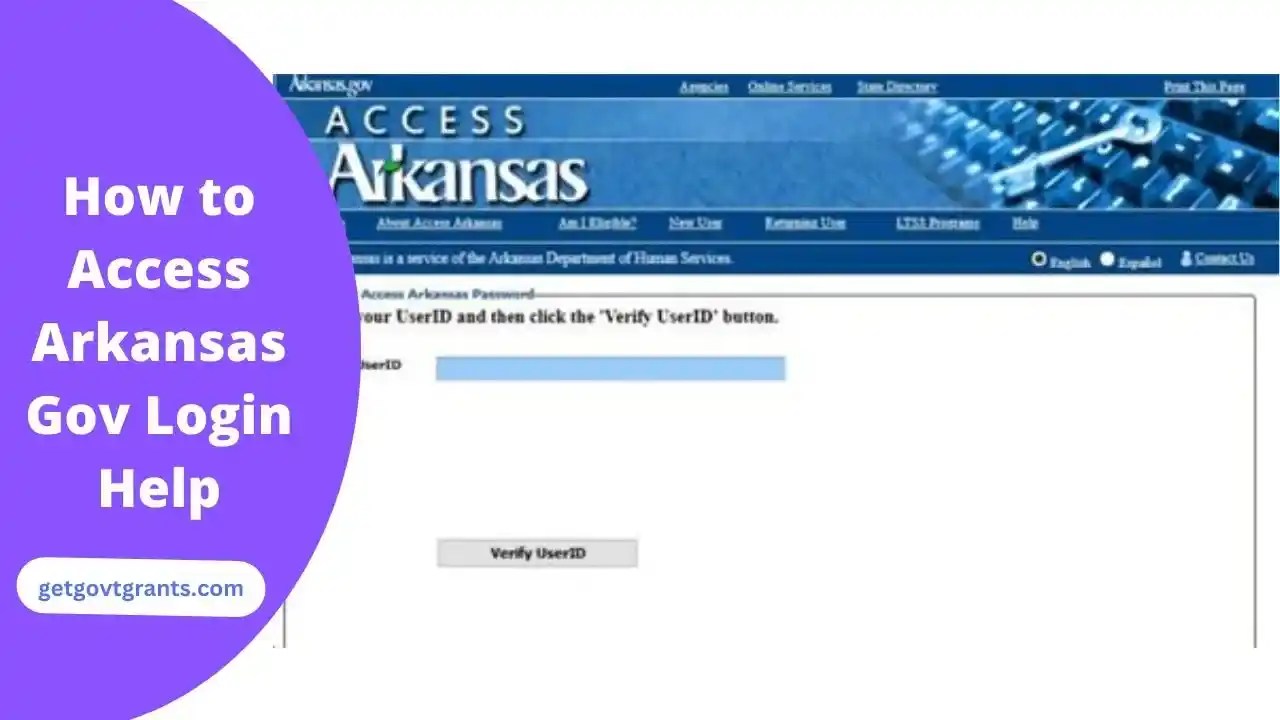

How to Access Arkansas Gov Login Help 2024

Arkansas 529 Plan Rules And College Savings Options

ADFA Form 529 Fill Out, Sign Online and Download Fillable PDF, Arkansas Templateroller

Arkansas Department of Education Home

Arkansas logs 529 new confirmed cases, 19 additional deaths News

Fillable Online Forms Arkansas 529 Fax Email Print pdfFiller

The Arkansas Brighter Future 529 Plan Is Designed To Help Families Reach Their Educational Goals.

Create A Username And Password More Questions About Logging.

Arkansas Brighter Future 529 Plan.

Related Post: